Executive Summary

Government financial reports are lengthy, cumbersome, and sometimes misleading documents. At Truth in Accounting (TIA), they believe that taxpayers and citizens deserve easy-to-understand, truthful, and transparent financial information from their governments.

This is TIA’s sixth annual Financial State of the Cities (FSOC) report, a comprehensive analysis of the fiscal health of the nation’s 75 most populous cities* based on fiscal year 2020 annual comprehensive financial reports. This report shows the cities’ finances during the onset of the global COVID-19 pandemic and lockdowns. For most cities, fiscal year (FY) 2020 ran from June 1, 2019 to June 30, 2020.

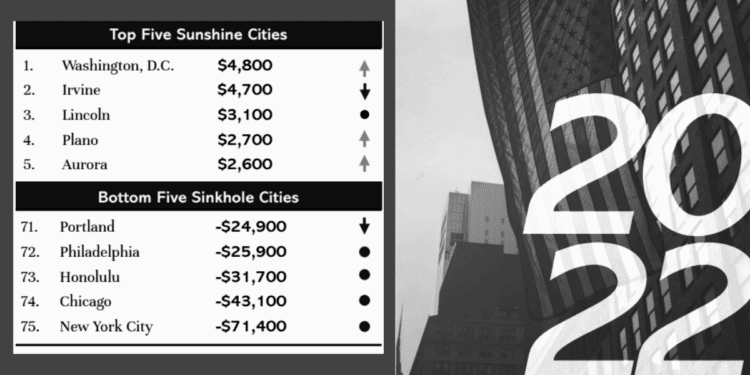

At the end of FY 2020, 61 cities did not have enough money to pay all their bills. This means that to “balance the budget,” elected officials did not include the true costs of the government in their budget calculations and have pushed costs onto future taxpayers. TIA divides the amount of money needed to pay bills by the number of city taxpayers to come up with the Taxpayer Burden™. If a city has money available after all bills are considered, that surplus amount is likewise divided by the number of taxpayers to come up with the Taxpayer Surplus™. They then rank the cities based on these calculations.

TIA assigned grades to the cities to give greater context to each city’s Taxpayer Burden™ or Taxpayer Surplus™. A municipal government receives a “C” or passing grade if it comes close to meeting its balanced budget requirement, which is reflected by a small Taxpayer Burden. An “A” or “B” grade is given to governments that have met their balanced budget requirements and have a Taxpayer Surplus. “D” and “F” grades apply to governments that have not balanced their budgets and have significant Taxpayer Burdens. Based on their grading methodology, no cities received A’s, 14 received B’s, 26 received C’s, 29 received D’s, and six cities received failing grades.

Cities, in general, did not have enough money to pay all of their bills. Based on TIA’s latest analysis, the total debt among the 75 most populous cities amounted to $357 billion. (Our analysis does not include capital assets or related debt.) Most of this debt comes from unfunded retirement benefit promises, such as pension and retiree healthcare debt. For FY 2020, pension debt accounted for $194.9 billion, and other post-employment benefits (OPEB) totaled $164.8 billion.

Click here for the full report.

Beyond the spectacle, Kansas City prepares for World Cup reality